JPMorgan Chase and the Heron Foundation Award Multi-Million Dollar Grants to Help Build the Alliance and Launch Three Initial Place-Based Pilot Programs

Ellis Carr, president and CEO of Capital Impact Partners, and Kurt Chilcott, president and CEO of CDC Small Business Finance

Nationwide — CDC Small Business Finance, the nation’s leading mission-based small business lender, and Capital Impact Partners, a Community Development Financial Institution (CDFI) that champions social and economic justice nationally, are proud to announce a new alliance. With a focus on economic empowerment and equitable wealth creation, the two organizations have the unique ability to deliver a full suite of lending products and programs that support community efforts to create strong, vibrant, and healthy places of opportunity.

Realizing the need for a new approach to implement scalable solutions that address the widening racial wealth gap, CDC Small Business Finance and Capital Impact have been in conversation for more than a year and, last fall, began to work diligently together to create the foundation for this new enterprise effort. Today the need is greater than ever as generations of systemic inequality are magnified by the disproportionate impacts of COVID-19 on Black and Latinx communities, as well as the issues raised through the racial justice groundswell.

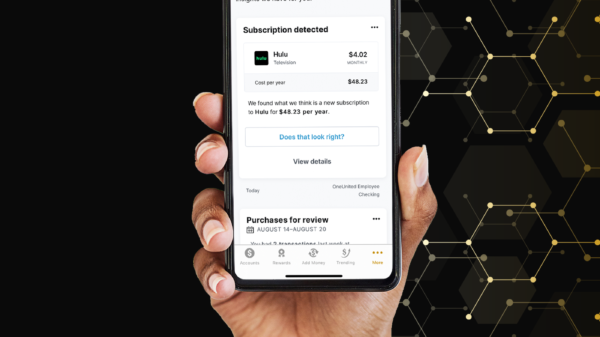

The alliance will immediately focus on supporting recovery and relief needs of community members, small businesses, and organizations, delivering key social services that have been devastated by these uncertain times. With a $4 million grant from JPMorgan Chase as part of its effort to support underserved small businesses and a grant from the Heron Foundation, CDC Small Business Finance and Capital Impact are well-positioned to scale the alliance’s impact.

“Issues of access and opportunity in American communities require bold new thinking to drive measurable change in community and economic development,” said Ellis Carr, president and CEO of Capital Impact Partners. “We understand that banks, funders, and other institutions have historically been challenged to connect capital to communities. By leveraging our unique expertise, complementary mission-based approaches, and holistic strategies, it is our hope that the alliance will accelerate solutions to address critical needs at scale.”

“Capital Impact and CDC Small Business Finance are industry leaders with a track record of driving innovative community development with an equity lens. Now, at a time when CDFIs and CDCs play a critical role in the COVID-19 economic recovery, their alliance reimagines the scope, scale and impact mission-based lenders can have on underserved communities,” said Ted Archer, Head of Small Business Forward at JPMorgan Chase. “JPMorgan Chase is proud to support this alliance and deepen impact, particularly in communities of color.”

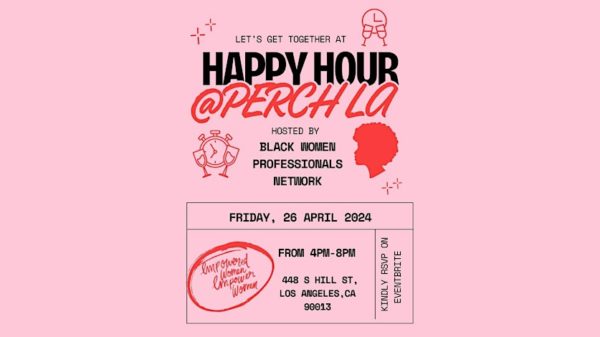

Work will begin through three place-based pilots in the Los Angeles, Detroit, and Washington, D.C. Metropolitan (DMV) areas. In each community, cross-organizational teams will listen and actively engage with local community members to understand the problems that are unique to each region, while sharing tools, programs, and services that are strategically customized to address high-priority issues.

The locations of the three pilots were intentionally chosen based on the current geographic focus for place-based community empowerment strategies within both organizations. Capital Impact is headquartered in Arlington, Va., with significant experience in the DMV for initiatives such as the DHCD Preservation Fund and Entrepreneurs of Color Fund. Similarly, Capital Impact has been engaging with partners in Detroit since 2011 and has been deeply involved in launching the Detroit Neighborhoods Fund and Equitable Development Initiative.

CDC Small Business Finance was founded in San Diego and today still offices there as well as locations and teams across California, Arizona, and Nevada. For over four decades CDC Small Business Finance has helped California small business owners access more than $18.6 billion in financing. With an office in Oakland for the past two decades, Capital Impact already has a history of community and economic development that complements CDC Small Business Finance’s SBA lending activities across California.

Efforts will be replicated and expanded in other parts of the country based on lessons learned through the initial pilots in these three cities.

Collaboration with the New Alliance

Over the last 41 years, the individual impact that CDC Small Business Finance and Capital Impact have each made in their respective areas of focus have totaled over $23 billion. Capital Impact Partners has invested more than $2.5 billion to community facilities and other intermediaries focused on equitable access to affordable housing, health care, food, and education. Across all programs, CDC Small Business Finance has helped small businesses access over $20.7 billion in financing. This deep and proven expertise will shape how the alliance works across:

• Communities—City and State: The experience of both organizations will allow for a spectrum of solutions to be created in partnership with communities, addressing whole-person strategies to influence measurable, systemic change. Partnerships will occur at all levels of community and economic development, including community members, organizations, financial institutions, investors, philanthropy, and government.

• Lending and Capital Industries: Industry innovation is critical to meet the immense challenges American communities face in achieving racial, social, and economic justice. The alliance will holistically focus on economic empowerment and wealth creation by jointly developing solutions that are uniquely tailored to solve for the specific issues facing each community.

• Funders and Investors: By joining forces, the organization will, over time, work to become a collaborative conduit and partner to banks, funders, and large institutions in an effort to help them overcome legacy challenges in effectively connecting capital to communities.

“Community development without economic development does not build intergenerational wealth and pathways out of poverty. And, economic development without community development can lead to gentrification and displacement,” commented Kurt Chilcott, president and CEO of CDC Small Business Finance. “With the alliance, it is our hope that a holistic approach that is inclusive, collaborative, and equitable will drive greater impact than what the industry has seen before. In order to be successful, we realize we must create solutions that consider that every community and its residents have varying needs, backgrounds, and access.”

Capital Impact and CDC Small Business Finance were first introduced to each other by Next Street, a mission-driven advisory firm that had been advising each of the organizations about their individual strategic planning process. Next Street has continued to play an integral role in helping to shape the alliance to help maximize the organization’s complementary expertise for maximum social impact.

Additional Background

• CDC Small Business Finance is a leader in the community and economic development field, providing access to transformative products, services, and advocacy to ensure all small businesses have the opportunity to succeed and grow. Key offerings include:

o Commercial real estate lending

o Small business lending

o Business advising services

o Advocacy and policy

• Through capital and commitment, Capital Impact helps people build communities of opportunity that breaks down barriers to success. Core offerings focus on:

o Mission-driven lending

o Capacity building and technical assistance programs

o Public policy

For more information, please contact alliance@capitalimpact.org

ABOUT CDC SMALL BUSINESS FINANCE

CDC Small Business Finance is the nation’s leading mission-based small business lender, award-winning nonprofit and advocate for entrepreneurs. Over four decades, the organization has provided more than 12,000 small business owners access $20.7 billion in financing. CDC Small Business Finance’s small business and commercial real estate loans have also played a critical role in bolstering economic development, and helping to create and preserve more than 209,000 jobs in California, Arizona and Nevada. For more information, please visit cdcloans.com.

ABOUT CAPITAL IMPACT PARTNERS

Through capital and commitment, Capital Impact Partners helps people build communities of opportunity that break barriers to success. Through mission-driven financing, social innovation programs, capacity building, and impact investing, we work to champion key issues of equity and social and economic justice. Our commitment to community focuses on ensuring that individuals have access to quality health care and education, healthy foods, affordable housing, cooperative development, and the ability to age with dignity.

A nonprofit Community Development Financial Institution, Capital Impact has disbursed more than $2.5 billion since 1982. Our leadership in delivering financial and social impact has resulted in Capital Impact being rated by S&P Global and recognized by Aeris for our performance. Headquartered in Arlington, VA, Capital Impact Partners operates nationally, with local offices in Austin, TX, Detroit, MI, New York, NY, and Oakland, CA. Learn more at www.capitalimpact.org.